SWAP is a procedure for transferring a position to the next trading day. In this case, a SWAP commission is written off/accrued, depending on the direction of the transaction.

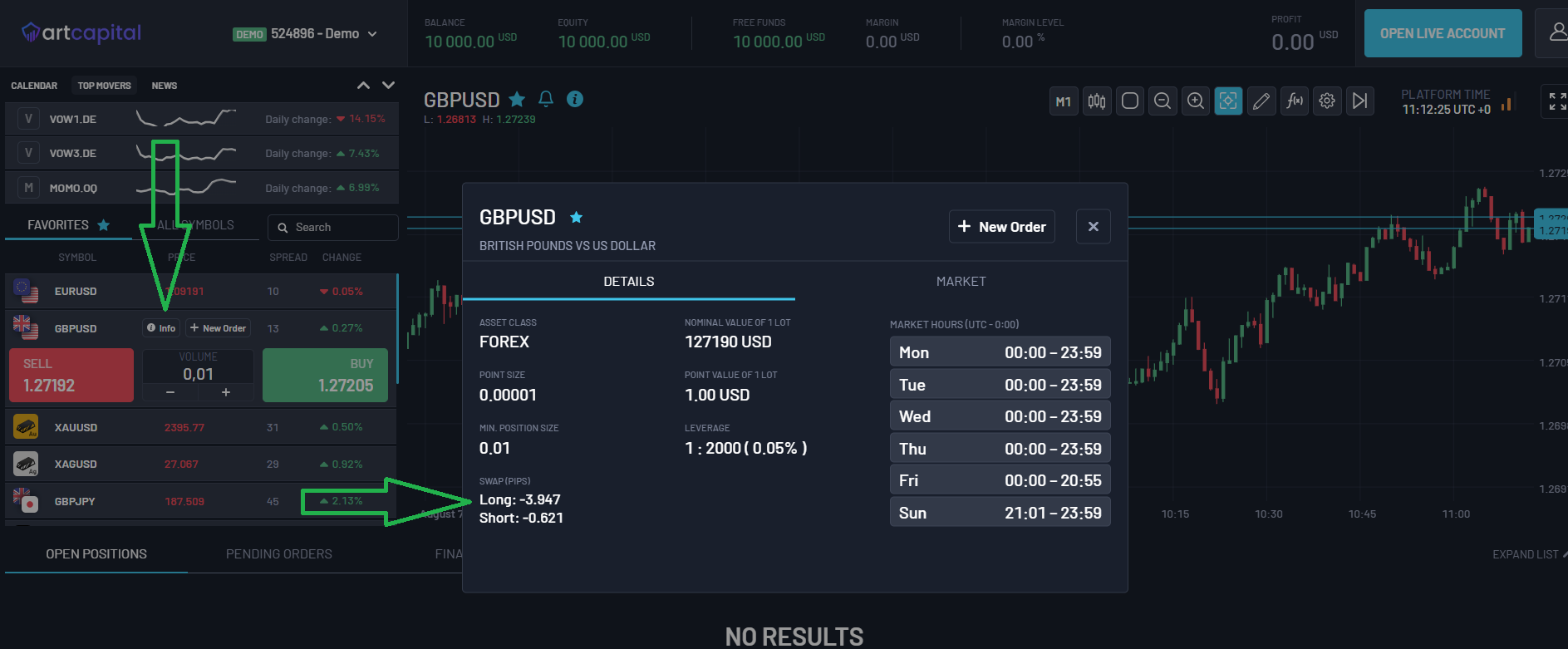

SWAP commission sizes vary depending on the broker, trading platform and trading instrument. Detailed information on each trading instrument (including the size of the SWAP accruals) is available on the platform.

On which days is SWAP charged?

For most trading instruments (except cryptocurrencies), SWAP is charged when moving to the next trading day, i.e. according to the following scheme:

- from Monday to Tuesday;

- from Tuesday to Wednesday;

- from Wednesday to Thursday;

- from Thursday to Friday;

- from Friday to Monday (the charge is made on the night from Friday to Saturday)

For cryptomarket:

- from Monday to Tuesday;

- from Tuesday to Wednesday;

- from Wednesday to Thursday;

- from Thursday to Friday;

- from Friday to Saturday;

- from Saturday to Sunday;

- from Sunday to Monday.

Why is a triple SWAP charged?

The procedure for transferring a position to the next day is carried out according to the scheme accepted worldwide - SWAP TOM NEXT. This means that for all transactions concluded on the current business day, the entire amount of currency must be delivered on the second business day. To avoid this delivery, it is necessary to make a SWAP transaction, which allows settling the obligations of the parties. Since when transferring an open position from Wednesday to Thursday, delivery to the second day would be made on Saturday, and Saturday is a day off (like Sunday), delivery is postponed to the next business day - Monday. Therefore, the swap is accrued/written off in triple size. Depending on the specifics of the trading instrument and the platform where the transaction is made, the accrual/writing of triple SWAP occurs differently.

How do you know if the SWAP will be positive or negative?

For example, you can compare the rates on the EUR/USD currency pair. The ECB rate is currently at 0% (loans are essentially free), and the Fed rate is set at 0.25%.

Thus, if we buy a currency pair, we must subtract the rate of the quoted currency from the rate of the base currency: 0 - 0.25 = -0.25. That is, when buying this pair, the difference in rates is negative, and therefore the SWAP will be negative.

But when selling a pair, we must, on the contrary, subtract the base from the quoted: 0.25 - 0 = 0.25. The SWAP will be positive.

In addition to the fact that SWAPS can be positive and negative, they can also be long and short (see photo below)

How to check SWAP: choose asset, then press info tab.

If you have open positions:

We wish you successful trading with ArtCap !